The government has abolished stamp duty on a number of polices taken out by a small business. In order to gain the exemption, the business must be a small business in accordance with the Income Tax Assessment Act 1997 (s152.10),Capital Gains Tax meaning, for the income year in which the insurance is effected or renewed. A small business for Capital Gains Tax purpose is, “an individual, partnership, company or trust that is carrying on a business, and has an aggregated turnover of less than $2 million.” Aggregated Turnover, is the insureds annual turnover plus the annual turnovers of any business entities that are affiliates or are connected with the insured.

If you are unsure if your small business qualifies for the NSW exemption, please contact Irecons office for assistance.

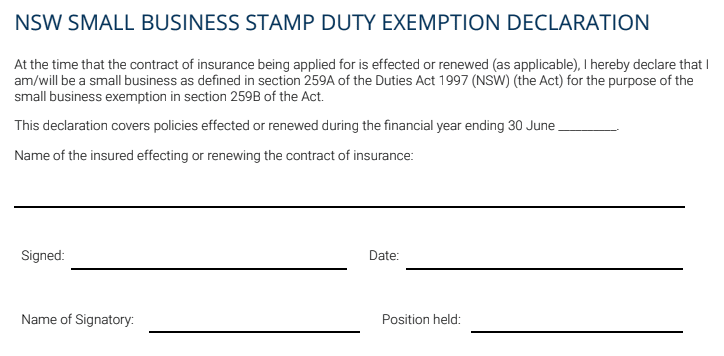

NSW SMALL BUSINESS STAMP DUTY EXEMPTION DECLARATION

CLICK TO DOWNLOAD